In a February interview with New York Magazine, Gary Gensler, chairman of the United States Securities and Exchange Commission, said that just about every crypto transaction, with the exception of Bitcoin spot transactions and buying or selling things with cryptocurrency, falls within the jurisdiction of the SEC.

In the interview, when discussing what types of crypto transactions should be regulated as securities, Gensler didn’t mince words. “Everything other than Bitcoin. You can find a website, you can find a group of entrepreneurs, they might set up their legal entities in a tax haven offshore, they might have a foundation, they might lawyer it up to try to arbitrage and make it hard jurisdictionally or so forth,” Gensler said.

Gensler continued, “They might drop their tokens overseas at first and contend or pretend that it’s going to take six months before they come back to the U.S., but at the core, these tokens are securities because there’s a group in the middle and the public is anticipating profits based on that group.”

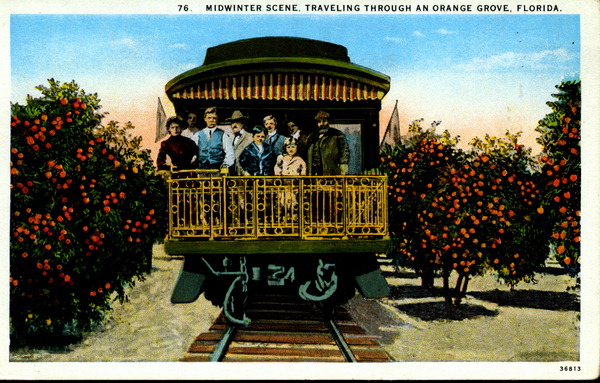

Gensler contends that the SEC’s jurisdiction over most cryptocurrencies is based on a 1946 Supreme Court ruling in the case SEC v. W.J. Howey Co. According to Investopedia, the W.J. Howey Co. sold citrus groves to Florida buyers. Those buyers would lease the groves back to the company. The company cultivated the trees and sold the oranges on behalf of the Florida buyers. Both would share in the profits. W.J. Howey Co. subsequently failed to register with the SEC, arguing that its transactions were not investment contracts.

W.J. Howey Co. lost the case when the court ruled that the leaseback arrangements were investment contracts, thus establishing the Howey test wherein four criteria are used to determine whether something constitutes an investment contract: An investment of money, in a common enterprise, with the expectation of profit, to be derived from the efforts of others.

Is Gensler right that most cryptocurrencies meet the Howey test?

Mark Bini, an attorney at Reed Smith, says “no.” Bini is a former state and federal prosecutor who now represents corporations and individuals facing civil and criminal charges of crypto fraud, securities fraud and other crimes.

“I think that the Howey test is not clear, and using this 1946 case about orange groves to decide whether a crypto is a security or not […] I’m not sure that they don’t need to update that,” Bini says. He also finds it surprising that a stablecoin pegged to the U.S. dollar might qualify as a security under the rule since there is no expectation of profit.

Bini asks, “Would Chairman Gensler say, if the United States launched a digital currency, as they’ve at least thought about doing, let’s say that there was a crypto that was a pure digital dollar, would that be a security?”

Congresspeople Jesús García and Stephen Lynch agree with Gensler. In a recent opinion piece for The Hill, they argue that participants in the crypto ecosystem must “come into compliance with existing securities laws.”

The lawmakers wrote, “According to the SEC Chair Gary Gensler and recent court decisions, the vast majority of crypto assets are securities because they meet the Howey Test […] An investment contract exists when money is invested in a common enterprise with the expectation of profit resulting from the work of others. We agree with Chair Gensler that nothing about the crypto markets is incompatible with the securities laws.”

With all the media coverage of Gensler’s recent statements, many in the crypto community might think that this is a new position for Gensler. Kevin Werbach, a professor at the University of Pennsylvania who leads the Wharton Blockchain and Digital Asset Project, tells Magazine otherwise.

“Both Chair Gensler and his predecessor, Jay Clayton, have repeatedly stated that the vast majority of digital assets are issued and purchased primarily for investment purposes and should be treated as securities,” says Werbach.

Werbach continues, “There are tens or hundreds of thousands of tokens out there — anyone can create one. The real issue relates to the projects that accumulated significant capital through the issuance of tokens. I think it’s fair to say that most of them would meet the Howey test in that issuance process […] But what does that mean today for ongoing trading and use of the tokens?”

Read also

Is the SEC regulating by enforcement?

On July 21, the SEC charged Ishan Wahi, a former Coinbase product manager, with insider trading, in addition to Wahi’s brother Nikhil and his friend Sameer Ramani.

From June 2021 to April 2022, Wahi allegedly shared confidential Coinbase information with Nikhil and Ramani, including upcoming token listing announcements. Nikhil and Ramani subsequently purchased and sold 25 crypto assets, at least nine of which, the SEC alleges, were securities. Profits accumulated in the scheme exceeded $1.1 million.

According to Bini, the crypto community has long claimed that the SEC has been regulating by enforcement, and in this case, the SEC determined what tokens were securities and subsequently charged the defendants with a crime based on those decisions.

On the same day that the SEC and the U.S. Department of Justice announced Wahi’s indictment, Commodity and Futures Trading Commissioner Caroline Pham released a statement lamenting SEC overreach. In her statement, Pham quoted the Federalist Papers, a document published over 200 years ago that focused on counterbalancing branches of government.

Pham also said, “The case SEC v. Wahi is a striking example of regulation by enforcement. The SEC complaint alleges that dozens of digital assets, including those that could be described as utility tokens and/or certain tokens relating to decentralized autonomous organizations (DAOs), are securities.”

Regarding the commissioner’s statement, Bini comments, “Pham really said, ‘Hey, you’ve overstepped here because there has been no action by Congress.’”

When asked if the SEC has been regulating through enforcement, as opposed to rulemaking, Werbach tells Magazine, “The securities laws are designed to be technology neutral, so there doesn’t necessarily have to be a rulemaking to determine how they apply to different situations involving digital assets. If the SEC did proceed with rulemaking — there are so many aspects to the digital asset world, and things change so quickly — that many decisions would need to be addressed through adjudication and enforcement.”

Werbach notes two challenges with the SEC’s enforcement strategy: “First, it’s sometimes hard to find consistency in the remedies and the choice of targets. Second, the agency has been reluctant to provide guidance, no action letters, or other paths to separate legitimate from non-compliant firms.”

Although debate continues about the SEC’s approach to enforcement, there is no doubt that the agency has beefed up resources. In May 2022, the SEC announced that it had added 20 positions to its Crypto Assets Unit, a department responsible for investor protection and cyber-related threats. According to the statement, the unit is part of the Division of Enforcement and will grow to 50 positions.

The SEC says the unit was established in 2017 and has brought more than 80 enforcement actions resulting in monetary relief exceeding $2 billion, and it will focus on investigating securities violations related to crypto asset offerings and exchanges, lending and staking protocols, decentralized finance platforms, nonfungible tokens and stablecoins.

Gensler believes that it’s all about protecting investors

When asked in his interview if a consumer-facing agency like the SEC is actively trying to discourage retail investors from participating in the crypto sector by delegitimizing crypto institutions, Gensler argued that his primary responsibility is investor protection.

Gensler said, “I’m in a job where I’m supposed to be merit neutral in terms of what risk investors want to take, but not neutral towards the investor protection — the full, fair, and truthful disclosure you get when you’re investing in a security.”

García and Lynch concurred, writing, “We agree with Chair Gensler that nothing about the crypto markets is incompatible with the securities laws and that investor protection is just as relevant, regardless of underlying technologies.”

The two members of Congress take it a step further arguing that existing security laws would force cryptocurrency exchanges, like FTX and others that lack corporate controls, “into compliance” and would protect investors from “bad actors.”

Bini thinks that the SEC does have a role when it comes to protecting investors, including those in the crypto space, it’s just that Gensler doesn’t have the authority to determine his own jurisdiction on the matter. “I understand the SEC’s mission is to protect investors. That’s a very important mission, no doubt about it […] I think the criticism by the crypto communities is [Gensler] cannot by his own fiat just decide his jurisdiction.”

As bad as Wall Street

Lynch and García argue that if crypto companies complied with existing securities laws, they wouldn’t be able to launder money, misuse customer funds, and engage in other nefarious behaviors.

The lawmakers wrote, “The crypto industry is notorious for attempting to obscure the law by using the courts to challenge attempts at regulation and lobbying for regulatory carve outs that benefit them at the expense of everyday people.”

García and Lynch cited a recent report from Reuters that alleges Binance, among other transgressions, lobbied the U.S. Department of Justice to try to sidestep enforcement. The CFTC recently sued the exchange’s CEO, Changpeng Zhao, for violations of the Commodity Exchange Act and CFTC regulations.

Although they expand the argument beyond a defense of Gesler and the SEC’s actions, they point out that FTX and other crypto stakeholders have “replicated the worst tendencies of Wall Street and Big Tech,” have “recreated many elements of the 2008 financial crisis,” “have subjected investors to incredible volatility,” and have “preyed on consumers.”

“Policymakers must protect our economy from bad actors by urging the crypto industry to comply with existing laws, invest in solutions that are truly innovative, and create a more inclusive financial system,” they wrote.

What about legislation?

Federal legislation would certainly create guardrails around the SEC and would help determine what federal agencies are tasked with regulating different types of cryptocurrencies.

Werbach says, “There are some areas, such as the treatment of stablecoins, where there simply isn’t an appropriate existing federal framework, and there are important tax issues that will likely need legislative resolution. The CFTC needs greater legislative authority over spot markets in digital assets. With regard to securities regulation, the SEC could provide more guidance without legislation, but it has declined to do so.”

Bini believes that effective legislation, like a stablecoin bill currently pending in Congress, would make investors feel more confident.

“It’s unfortunate that there hasn’t been a clear framework by the United States because I think it’s going to provide clarity to the industry. People who want to put money in crypto feel more confident if they feel like there’s a clear framework and that they’re being protected, whether it’s the SEC or the CFTC, or if Congress came up with some new agency that was going to oversee crypto,” says Bini.

Bini adds, “I don’t think that it’s up to him [Gensler] to decide where the SEC reaches in — that should be up to Congress.”

Read also

Maybe the courts will decide

Since the Howey test, a precedent established by a court decision, is the current method of determining whether something is a security, is it possible that the courts could set a similar precedent for cryptocurrency?

According to Bini, the answer is maybe, perhaps out of the Ripple case that’s playing out in the Southern District of New York. Bini says “that in the absence of Congressional action, you could have a landmark case like this one appealed to the Second Circuit, and then the Supreme Court, and that may provide clarity.”

In December 2020, the SEC filed an action against Ripple Labs alleging that the company and two of its executives raised over $1.3 billion in an unregistered, ongoing securities offering.

Last year, the judge in the Ripple case agreed to consider the fair notice defense, a protection derived from the Due Process Clause in the U.S. Constitution that guarantees a defendant be given fair notice of what constitutes an offense.

The SEC unsuccessfully tried to quash the motion. Using the fair notice defense, Ripple Labs’ attorneys argued that the company couldn’t have known that Ripple’s XRP token should have been registered as a security with the SEC because the agency never provided adequate guidance about what cryptocurrencies actually qualify as such.

“The Second Circuit or the Supreme Court could endorse the SEC’s approach and note the continued vitality of Howey as applied to digital assets. Conversely, the Second Circuit and/or the Supreme Court could find for Ripple and reject the SEC’s approach. That could provide clarity in this area,” Bini says.

Irrespective of how this plays out, Gensler’s macro overview of cryptocurrency is clear, and the question remains as to how it might affect his regulatory proclivities. In the interview, he said, “I don’t think there’s much economic use for a micro-currency, and we haven’t seen one in centuries. Most of these tokens will fail, because the question is about these economics. What’s the ‘there’ there?”

Subscribe

The most engaging reads in blockchain. Delivered once a

week.