Localbitcoins, the Helsinki, Finland-based bitcoin exchange founded in 2012, is closing operations after over a decade of service. The company’s operators attribute the shutdown to the “ongoing crypto-winter,” which has left them unable to continue offering their bitcoin trading services.

The Challenges Faced by Localbitcoins and its Ultimate Demise in the Crypto Market

The first peer-to-peer (P2P) bitcoin exchange, Localbitcoins, is ending operations after over ten years in the business. The exchange announced the news on its website, stating that new sign-ups will be suspended as of Feb. 9, 2023, and trading will be suspended seven days later, on Feb. 16. Following the suspension of trading, Localbitcoins users will only be able to withdraw their bitcoins and have 12 months to do so.

“Originally Localbitcoins was established to bring bitcoin everywhere and drive global financial inclusion,” the company stated on Thursday. “We have honored that mission for over 10 years and we are proud of what we have achieved together with all of you, our loyal community.” The bitcoin exchange added:

We are therefore sad to share, that regardless of our efforts to overcome challenges during the ongoing very cold crypto-winter, we have regretfully concluded that Localbitcoins can no longer provide its bitcoin trading service.

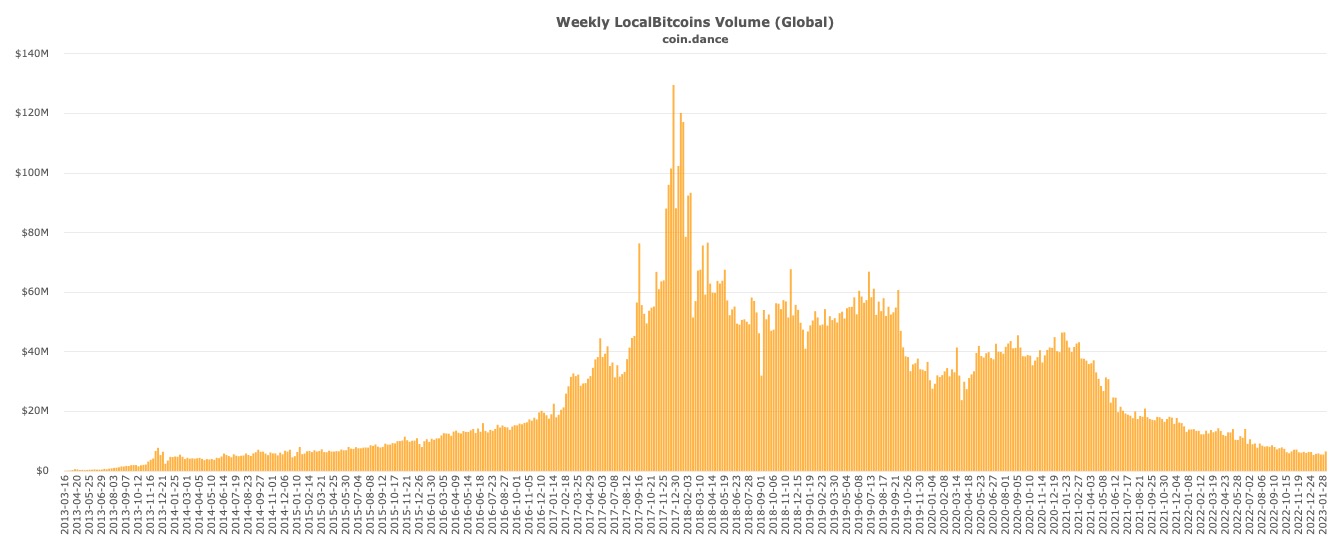

In its early years, Localbitcoins was the preferred exchange for peer-to-peer trades globally. The platform saw strong volume in its first few years, but centralized crypto exchanges eventually surpassed it, leading Localbitcoins to become more prominent in regions without centralized trading options.

By 2019, the peer-to-peer exchange faced further challenges when it was required to comply with Know-Your-Customer (KYC) regulations. Additionally, Localbitcoins ended in-person trades that year, making the platform less appealing for peer-to-peer traders.

In 2021, during the crypto bull market and resurgence in digital currency prices, Localbitcoins announced the launch of an Android mobile app. Despite this, Localbitcoins never regained the volume it saw in 2017. Even during the 2021 bull market, the platform’s volume continued to decline. Statistics show that Localbitcoins’ volume is currently as low as it was during the 2015 bear market. The first week of February 2023 saw a slight increase, with 6.56 million BTC traded over a seven-day period.

What do you think is the future of peer-to-peer cryptocurrency exchanges after the closure of Localbitcoins? Share your thoughts in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Editorial photo credit: T. Schneider / Shutterstock.com

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer