On April 6, onchain data shows the Luna Foundation Guard’s (LFG) bitcoin wallet has added 5,040 bitcoin to its reserves. The added funds were worth roughly $221 million at the time of settlement. LFG managed to purchase the bitcoins while bitcoin lost 3.9% against the U.S. dollar during the last 24 hours.

LFG Buys the Dip Acquiring 5,040 More Bitcoin

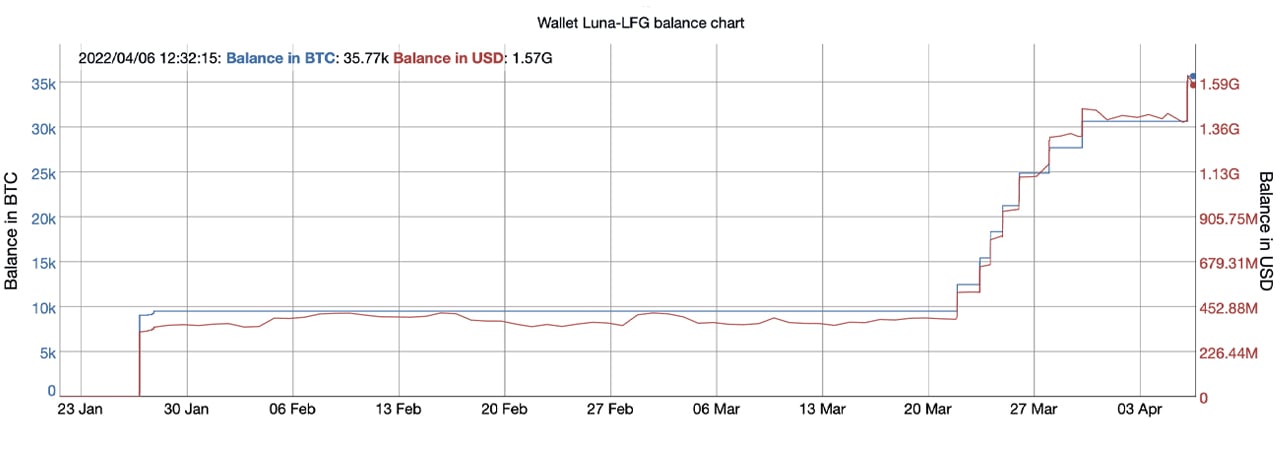

The team behind the Terra (LUNA) network and the non-profit based out of Singapore, the Luna Foundation Guard (LFG), continue to stack bitcoin. Less than a week ago, Bitcoin.com News reported on LFG’s wallet and explained that it held 30,727.97 BTC.

At the time, the stash was worth more than $1.4 billion using BTC exchange rates from six days ago. For roughly six days, the LFG bitcoin stash didn’t see any additional deposits.

That changed on April 6, when the LFG bitcoin wallet received 2,485 BTC at 6:57 a.m. (UTC) and continued to recieve payments until a total of 5,040 BTC was added. It’s worth noting that LFG’s bitcoin wallet gets dust transactions sent to it, as this is a common occurrence with well known wallets with sizable amounts of bitcoin.

After acquiring the 5,040 BTC, LFG’s wallet now holds 35,767.98 BTC worth $1.58 billion at the time of writing. According to the Bitcoin Rich list hosted on bitinfocharts.com, the LFG wallet, which is flagged as “Luna-LFG,” now holds the 21st largest bitcoin wallet position.

Six days ago, the wallet was the 29th largest wallet. In order for the LFG bitcoin wallet to surpass Tesla’s bitcoin balance sheet, the wallet needs more than 7,135 BTC. Despite this, LFG’s bitcoin wallet is larger than every other publicly-listed company’s BTC treasury except for Tesla and Microstrategy.

LFG’s wallet value is currently half of the $3 billion worth of BTC Terra’s founder Do Kwon hinted the project would purchase in March. The project has managed to purchase the BTC while bitcoin’s price dropped 3.9% during the last 24 hours.

Bitcoin’s USD value dropped to a low of $43,388 on Wednesday on the exchange Bitstamp. LFG’s purchase of 5,040 BTC also follows Microstrategy’s purchase of 4,167 bitcoins the day before. Microstrategy’s buy on Tuesday lifted the company’s balance to 129,218 bitcoins.

What do you think about the Luna Foundation Gaurd’s bitcoin wallet acquiring 5,040 more bitcoin? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, bitinfocharts.com/bitcoin/wallet/Luna-LFG

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer