The crypto economy has come awfully close to nearing the $3 trillion handle as far as the value of all 10,000+ crypto assets is concerned. Today, crypto market aggregation sites show the entire crypto-economy at $2.756 trillion is worth more than the value of Apple’s market cap at $2.467. Furthermore, the top ten crypto-asset exchanges, in terms of cryptocurrencies held in reserves, hold more than $200 billion or 7.47% of the entire crypto economy.

10 Centralized Crypto Exchanges Hold 7.47% of Crypto Economy’s Value in Custody

Digital currencies are far more valuable today than they were a month ago and the crypto economy is coming close to topping $3 trillion in value. The whole crypto-economy surpassed Apple’s overall worth this past week as bitcoin (BTC) became the sixth-most valuable asset on earth and ethereum (ETH) is now the 15th-largest global asset. While BTC has a $1.2 trillion market cap, ETH commands a market valuation of over $500 billion.

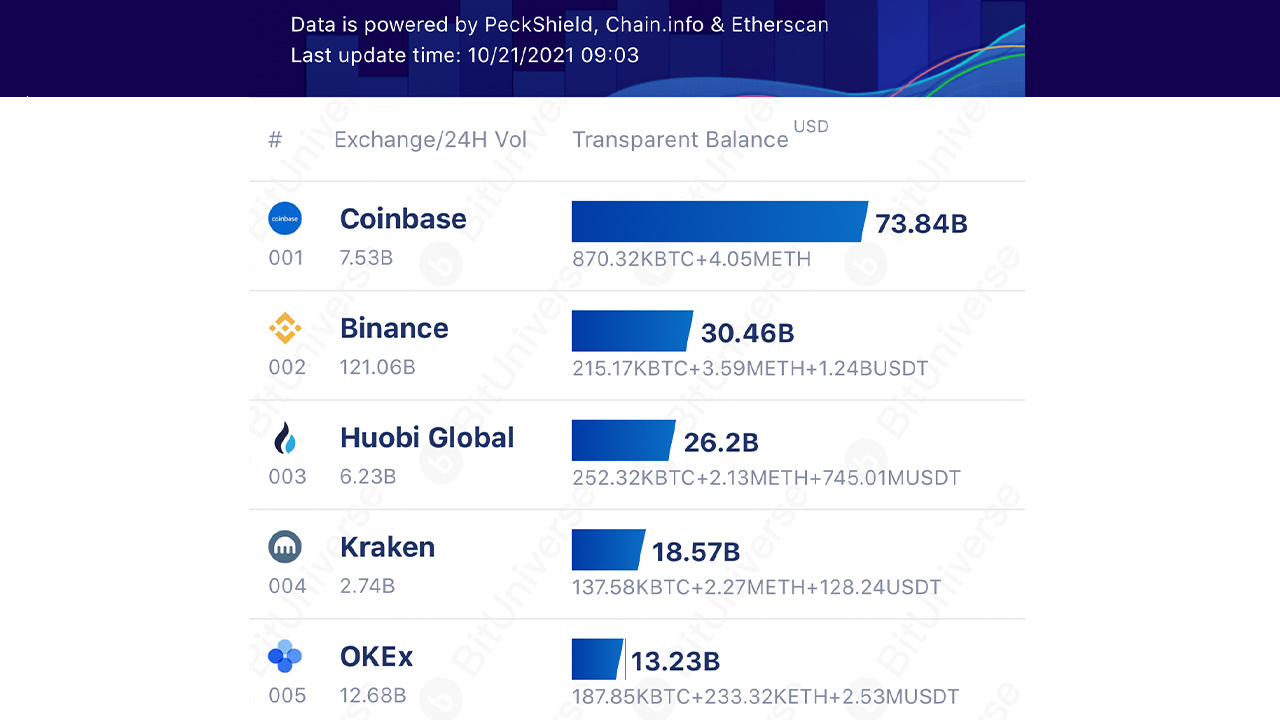

Meanwhile, the top ten crypto asset trading platforms, in terms of cryptocurrencies held in reserves, hold 7.47% of the entire crypto-economy under custody. The top ten crypto asset exchanges that hold the most value in crypto assets in custody are Coinbase, Binance, Huobi Global, Kraken, Okex, Gemini, Bitfinex, Bittrex, Bitmex, and Bitflyer respectively. All ten of these exchanges on Thursday, October 21, 2021, hold approximately $206.263 billion using today’s exchange rates.

Coinbase Commands 35% of the $206 Billion Held in Reserves by Top 10 Trading Platforms

The “Exchange Transparent Balance Rank” data on Thursday is provided by Bituniverse with help from Peckshield, Etherscan, and Chain.info. Out of the whopping $206 billion held on centralized exchanges, Coinbase holds 35.84% with $73.84 billion held in reserves. Binance holds 14.78% of the $206 billion with $30.46 billion. Both Bitmex and Bitflyer hold the least amount of crypto reserves in the top ten positions, with Bitmex holding $7.27 billion and Bitflyer holding $4.89 billion in crypto reserves.

All ten of these exchanges combined hold more value than the overall market capitalization of Fortune 500 companies like Comcast, Pfizer, Cisco, Coca-Cola, and Intel. It’s safe to say that the top ten crypto exchanges in terms of crypto reserves held in custody are becoming heavyweight behemoths in the world of finance, thanks to the growing value of the crypto economy.

What do you think about the top ten crypto exchanges holding $206 billion in cryptocurrencies? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer